Bootstrapping SaaS Startups

Rick Gregg June 27,2024 What do you think?

Current Funding Environment

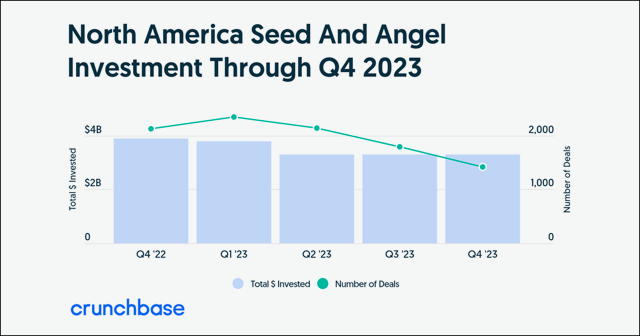

Venture capital financing is the exception, not the norm, among start-ups. Investors want to be convinced you really know who your customer is. They also want to see some amount of early revenue. All before even considering an investment. 300,000 SaaS startups in North America competed for $5.4B in seed and angel investment during 2023. Less than 1% or approximately 3,000 startups received funding after dedicating countless hours over at least 12 months raising money.

Increase Your Chances for Success

The saasmvp Project is out to change all of that by leveling the playing field. Our open source Minimum Viable Product (MVP) SaaS framework lets you focus your valuable time and money on customer discovery, customer validation, and that all important early revenue generation milestone on your own without any outside investment. This approach will raise your valuation and allow you to keep more of your equity making an investment in your SaaS startup less risky. Or keep the equity yourself! What are your thoughts? I’d like to hear from you. In the meantime, keep building.

Methodology

In 2023, Crunchbase estimated there was $13.7B invested in 7,670 Venture capital funded seed and angel deals with Carta claiming that SaaS startups account for 39.2% of seed and angel capital raised. Consider the following:

- 300,000 North American angel and seed stage SaaS startups sought funding in 2023. One percent (.01) received funding. ((7,670 * .392)/.01 = 300,000)

- 3,000 North American angel and seed stage SaaS startups received funding in 2023. (300,000 * .01 = 3,000)

- $5.4B was invested in 3,000 North American angel and seed stage SaaS startups in 2023. ($13.7B * .392 = $5.4B)