Overcoming Buyer Resistance

Rick Gregg August 17,2024 What do you think?

In my last post, I discussed the importance of uncovering the tricky customer pain of Emotion. In the last part of this four part series, I will continue my discussion of the four frictions that cause innovation headwinds and prevent your customer from buying. In summary, these frictions are: 1) Inertia (part one), 2) Effort (part two), 3) Emotion (part three); and 4) Reactance (this post).

Why We Feel the Impulse to Resist Change

If inertia is the resistance to change, Reactance is the resistance to being changed. In their groundbreaking 2022 book “The Human Element,” authors Loran Nordgren and David Schonthal point out that “people don’t like having change imposed on them. We don’t like being told what to do. This is a major obstacle for the innovator, because innovation is the act of changing what people do. This means that the innovator’s objective is at odds with our human nature. And when people feel they are being pressured to change, the automatic reaction is to react against change. This phenomenon is known as Reactance. Reactance leads us to see new ideas not as opportunities, but as invaders. We raise the drawbridge and arm the gates.”

Humans have a fundamental need for freedom over their environment. Freedom is a basic human need because it is essential for survival. Freedom allows us to select options that are beneficial and desirable and avoid options and outcomes that are detrimental. The trouble is, when we attempt to influence people we are, in effect, imposing on their freedom. We are attempting to push them down a particular path. When people feel their freedom being threatened, their instinct is to restore the freedom by pushing back.

Don’t Add Features

Innovators quickly learn to expect new ideas to be met by knee-jerk doubt and disapproval. When we encounter resistance to a new idea, the innovators impulse is to add features. We are attempting to overcome buyer resistance by igniting the idea with features in the hope of providing more evidence and encouragement to get them to adopt. However, by creating more change through the addition of features, we create an unintended consequence of even more Reactance.

Overcoming Reactance

The secret to overcoming Reactance is to stop pushing for change. Rather than attempting to persuade others, we should try and help them persuade themselves. This approach uses self-persuasion which occurs when the arguments and insights for change come from within. Rather than telling people what to think, self-persuasion uses questions that lead to self-discovery. Oftentimes self-persuasion is the only technique that will work to overcome Reactance.

Ask Yes Questions

When practicing self-persuasion, asking is a better approach to getting buy-in than telling people what to do. New innovations and ideas will be more easily accepted if we begin with questions that reveal acceptance and common ground. Getting people to say yes to small requests, such as giving feedback stokes self-persuasion because it makes them feel more involved in the process. By the time they get to the big request, they already identify with the idea. To calculate the degree of Reactance your innovation will produce, consider these three questions:

- Does my idea threaten a core belief? This question determines whether your audience is open-minded to the change you are trying to create. If your idea touches on issues you avoid at the Thanksgiving table (e.g. politics, religion, social justice), it’s probably a core belief.

- Does my approach pressure people to change? When people feel pressured to change, their instinct is to push back to maintain their autonomy. Pressure comes in many forms. Penalties for not changing, time pressure, and a demanding message all are strong Reactance generators.

- Was your audience excluded? Is the idea entirely yours or did your audience play a role in the process?

When asking yes questions contemplate the following:

- Are you asking or telling? Telling people what to do is a form of pressure. Asking removes Reactance.

- Are you asking a yes question? The innovator’s faulty instinct is to begin the conversation at the point of tension or disagreement. New innovations and ideas will be more easily accepted if we begin with questions that reveal acceptance and common ground.

- Can you create public commitments? Self-persuasion becomes more powerful when the commitment is made publicly. This has the effect of accelerating adoption from the like minded people that are resisting the change since one or more of their own is endorsing the concept among their peers.

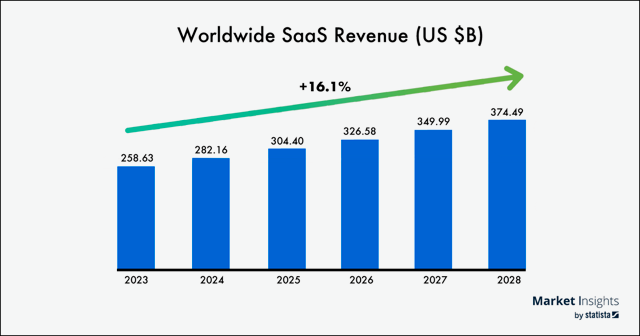

This wraps up our four part series on overcoming the resistance that awaits new ideas. We will be using the four frictions during customer discovery when we develop tests to measure the effectiveness of our customer profile and value proposition for our innovative SaaS offering. Want to learn more? Check out The Human Element book for more information and examples.

The saasmvp Project is dedicated to helping SaaS Entrepreneurs who want to create a repeatable SaaS business model and Minimum Viable Product (MVP) that generates revenue with minimal financial risk. We’re excited to help you discover your ideal SaaS customer profile and can’t wait to see what you build!